Wisconsin is making a calculated bet on fusion. On July 2nd, Governor Tony Evers signed two bipartisan nuclear innovation bills designed to position the state as a national leader in next-generation nuclear technology. Unlike most state-level nuclear policy, which focuses on fission, this legislation explicitly backs fusion energy development. It’s a notable shift with real implications for Wisconsin’s broader fusion ecosystem.

The legislation lays the groundwork for public-private collaboration across siting, regulation, and commercialization. Key provisions include:

$2 million for a fusion power plant siting study: The Wisconsin Public Service Commission will identify potential locations for a demonstration-scale fusion power plant, factoring in grid access, cooling water, workforce, and community impact.

Creation of a Nuclear Innovation Board and 2028 Summit: A new state board will steer both fission and fusion R&D, culminating in a Wisconsin Nuclear Power Summit in 2028. The timing coincides with when many fusion startups aim to begin deploying pilot reactors.

Streamlining advanced nuclear regulations: Regulators are directed to create approval pathways for advanced reactors, including fusion devices, ensuring Wisconsin is ready to host commercial-scale nuclear projects in the coming decade.

Taken together, the bills send a clear signal: Wisconsin is proactively building the regulatory and political infrastructure that first-of-a-kind projects need to succeed.

From Academia to Industry

The state’s fusion push isn’t starting from scratch. The University of Wisconsin-Madison has been a powerhouse in fusion science for over 50 years, producing hundreds of PhDs and operating one of the most comprehensive R&D programs in the U.S.

That academic pipeline has seeded a critical mass of commercial activity. Three of the nation’s most visible fusion companies, Realta Fusion, Type One Energy, and SHINE Technologies, can all trace their roots to UW-Madison research:

Realta Fusion was founded in 2022, spinning out of a $10M ARPA-E project at UW-Madison focused on magnetic mirror confinement.

Type One Energy, a stellarator-focused startup, emerged from UW’s plasma theory group in 2019 and has since raised $82.4 million in seed funding.

SHINE Technologies, founded in 2005, is focused on neutron generation for medical isotopes and industrial applications. Nearly 20% of SHINE’s ~370 employees hold a degree from UW-Madison.

This geographic clustering, combined with university R&D and an advanced manufacturing base, gives Wisconsin the foundational elements for national leadership in fusion energy. The new legislation is designed to strengthen that position.

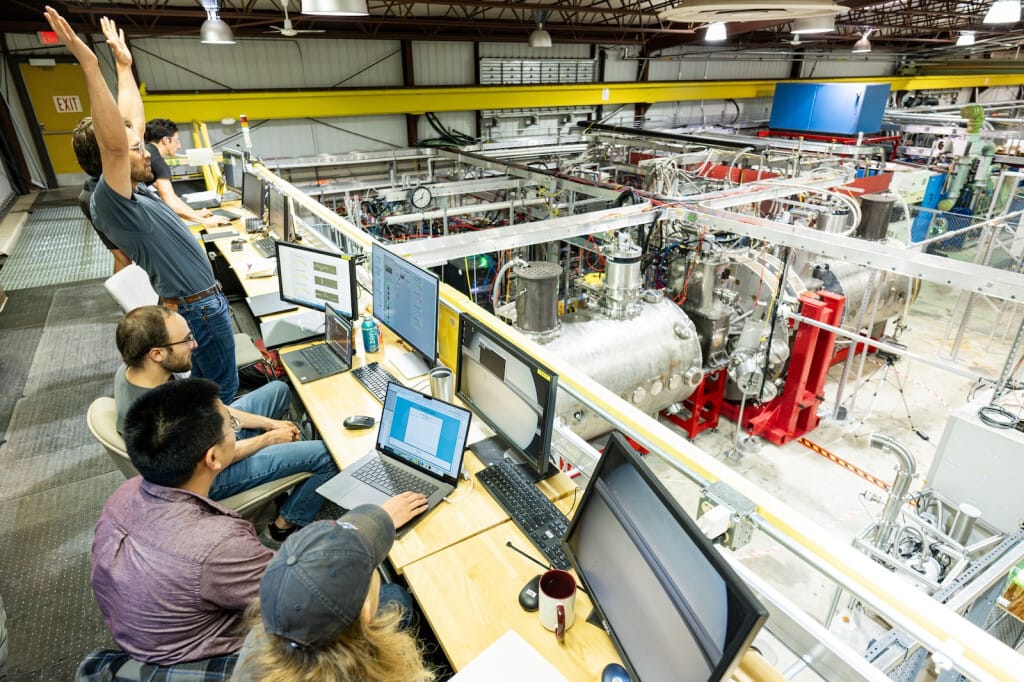

The WHAM prototype in operation at the Wisconsin Plasma Physics Laboratory. Photo by Bryce Richter/UW-Madison.

Who’s Best Positioned to Benefit?

Of the three fusion companies anchored in Wisconsin, we believe Realta Fusion is best aligned with the goals of the new legislation.

Type One Energy has already committed to building its first fusion pilot plant in Tennessee. That project, supported by the Tennessee Valley Authority (TVA) and the state of Tennessee, will repurpose a former fossil plant site and leverage TVA’s engineering workforce. While Type One may continue R&D in Wisconsin, its first major build is happening elsewhere.

SHINE Technologies, for its part, is a commercial fusion company—but not in the power generation business. It’s focused on neutron production for healthcare, industry and defense, and its systems do not require the infrastructure or policy support outlined in the new bills.

That leaves Realta Fusion. Based in Madison, the company is pursuing a magnetic mirror confinement system, an alternative to tokamaks or stellarators designed to scale with lower capital intensity and complexity. In July 2024, Realta achieved first plasma on its WHAM (the Wisconsin HTS Axisymmetric Mirror) prototype. Less than a year later, it closed a $36 million Series A led by Future Ventures.

The next step is Anvil, Realta’s pilot-scale device. The company expects to finalize the design by the end of its Series A and begin seeking construction capital for a late-2020s build. Wisconsin’s $2M siting study and regulatory streamlining could directly support this timeline.

Realta CEO Kieran Furlong has made it clear that Wisconsin is the intended launchpad: the company is expanding its Madison footprint, aiming to grow from 18 to ~30 employees by year’s end. It also sees Wisconsin’s emerging data center ecosystem, like Microsoft’s campus in the southeast of the state, as a potential first customer for on-site fusion power.

Looking Ahead

For investors and executives in the fusion industry, Wisconsin’s initiative is a case study in regional government backing. It shows fusion companies might find receptive partners not just at the federal level (through DOE grants and national labs) but also in state legislatures. A supportive state can offer flexible financing, workforce development, and smoother permitting, all key ingredients for first-of-a-kind builds.

Wisconsin’s example also highlights the value of clustering: having research universities and multiple startups in one area creates a positive feedback loop that policymakers can amplify. We’re seeing something analogous in the UK (with its fusion cluster in Oxfordshire) and in states like Massachusetts, where Commonwealth Fusion Systems enjoys strong state academia-industry networks.

While Wisconsin’s new laws don’t guarantee a fusion plant will be built in the state, they materially improve the odds. If the state can identify and prepare a viable site, offer permitting support, and maintain bipartisan engagement, it could well attract one of the first pilot deployments in the U.S.